Author: Julian Simmons

Build A Better Portfolio

Did you know that the average stock mutual fund investor under-performed the S&P 500 index (benchmark index that measures the stock performance of the 500 largest companies listed on stock exchanges in the United States.) by 4.86% per year over the five year period ending in 2017? Even worse, during the same period, the average fixed income investor actually received a negative return, even though bond market returns were positive for the period.

But, investing isn’t just about getting the returns you need. It’s also about managing risk and protecting your wealth. After all, no one wants to experience a significant investment loss in a market downturn.

Investment management clients at SROSE receive ongoing advice and management to improve expected returns, reduce risk, and fund the lifestyle they desire.

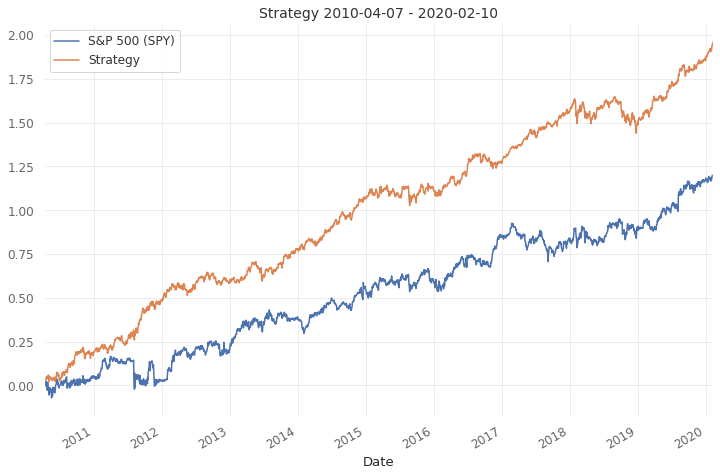

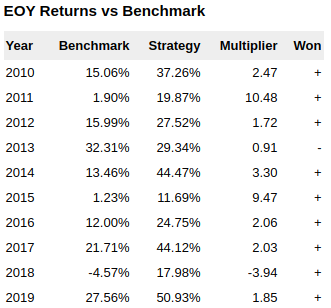

Robust Risk Parity ETF Strategy

View Full Stats Here

Avoid Significant losses

The thought of experiencing a significant investment loss during a market downturn can be stressful. The S&P 500 fell by 56.4% during the 2008 market crash. For investors , this type of loss can spell disaster. We leverage data science, machine learning and AI to better define risk to design and manage a portfolio that is personalized for your risk tolerance to help you sleep more soundly.

Better Returns

Based on a recent study from Vanguard, working with an investment advisor may improve your overall returns by only 3% or more annually. We’ll help calculate the return you need to achieve to accomplish your goals; then, we’ll help design and implement a personalized investment strategy to give you the highest probability of achieving that return.

Create Retirement Income

Are you concerned about creating income from your retirement portfolio? Creating a sustainable “paycheck” in retirement isn’t easy, but we’re experts in leveraging the speed and power of data to turn your portfolio into consistent income.